The CDC’s action regarding establishing a national eviction moratorium in response to the Covid 19 pandemic was never about due process. It was about shouldering U.S. landlords with $26.6 billion in debt not covered by federal financial assistance. Read about the National Apartment Association lawsuit against the federal government here.

Santa Barbara County Plans to Offer 100% Reimbursement of Unpaid Rent

This news has a short shelf life to act now!

This news has a short shelf life to act now!

Many rental property owners have applied to the California state program for reimbursement for up to 80% of unpaid rents due to the COVID-19 pandemic. However, this program is potentially going on leave shortly for 4-6 months.

The good news: As a result, the Santa Barbara County Dept. of Housing & Community Development has asked the County Board of Supervisotrs to increase the County’s limit of $6,000 reimbursement for unpaid rent to:

100% reimbursement for 15 month’s rent!

(the last 12 months delinquent rent and for 3 months into the future.)

This program is unique to Santa Barbara County. You will be able to receive 100% reimbursement instead of the 80% offered by the state! Final approval is pending on the County Board of Supervisors’ Consent Agenda for Tuesday, April 20. However, apply now! As of today, the County has $9,450,000 ERAP dollars remaining. Once the County ERPA funds are depleted, owners must apply to the State and receive must 80% reimbursement in addition to a long wait time.

First come, first served.

Get your delinquent tenants to apply immediately to the County ERAP, even if you have already applied to the state.

Apply here: https://www.unitedwaysb.org/rent

Further details are available on the SBSRPA (Santa Barbara Rental Property Association) website here:

Emergency Rental Assistance for Landlords – Santa Barbara Rental Property Association (sbrpa.org)

Covid-19 Response – Congress Needs to Support Owners and Residents!

I am a member of the Santa Barbara Rental Property Association (SBRPA) and by default the National Apartment Association (NAA). I don’t like getting involved in politics in relation to real estate, but it’s needed sometimes. I blame my anathema on my five-year stint on the Santa Barbara Association of Realtors Government Relations Committee. That title is as deadly as it sounds. Every meeting involved defense against never-ending onslaughts against real estate interests. It was depressing. I ended up doing another five plus years on the Santa Barbara Association of Realtors Statistical Review Committee. Oddly enough, service on this committee was much more uplifting! I did chair the committee for one term. I was the only chair who guaranteed that we would never go beyond the hour limit in our meetings!

I am a member of the Santa Barbara Rental Property Association (SBRPA) and by default the National Apartment Association (NAA). I don’t like getting involved in politics in relation to real estate, but it’s needed sometimes. I blame my anathema on my five-year stint on the Santa Barbara Association of Realtors Government Relations Committee. That title is as deadly as it sounds. Every meeting involved defense against never-ending onslaughts against real estate interests. It was depressing. I ended up doing another five plus years on the Santa Barbara Association of Realtors Statistical Review Committee. Oddly enough, service on this committee was much more uplifting! I did chair the committee for one term. I was the only chair who guaranteed that we would never go beyond the hour limit in our meetings!

The Covid-19 crises is in our face and the U.S. Congress and Senate and other state and local branches of government seem to be focusing a lot of energy in placing excessive burdens on multifamily property owners because of this crisis. Rent restrictions, eviction restrictions and moratoriums, even mandatory rent reductions in post crises unlawful detainer actions. There needs to be a more balanced, fair method in helping out than to single out providers of housing for such excessive and onerous treatment!

Please join me in petitioning members of Congress and Senate in a request to advocate for better measures rather than continue on the current track. Please take a minute to click this link and compose a brief statement of your relationship to the housing industry and sent it to our legislators. Locally this would be Representative Salud Carbajal, Senator Dianne Feinstein and Senator Kamala Harris. Thank you!

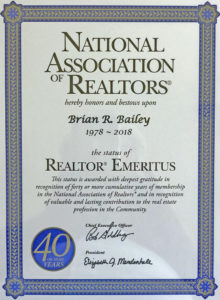

Brian Bailey – Realtor Emeritus!

I was recently honored with receiving the Realtor Emeritus designation at the Santa Barbara MLS meeting. This is a National Association of Realtors (NAR) designation for a salesperson or broker who has been in the business for 40 years and who has served on local Association of Realtors committees. Yes, receiving the award means that you are an old timer, but it also means that you no longer must pay the yearly NAR dues!

I served on the Government Relations Committee for many years and then on the Statistical Review Committee for many more. I was the head of this second committee for a term. I have to say that, as dry as the “Statistical Review Committee” sounds, it was way more uplifting than serving on the Government Relations Committee. The Government Relations Committee is the front line in the constant barrage of attacks against private property rights, additional limitations and taxes. These front-line efforts are needed, but I found it too depressing.

I began my real estate career in 1978, shortly after my graduation with honors from UCSB with a B.A. degree in English Literature in 1977. I had no idea what I was going to do to make money after college, but I knew it would work out just fine. Towards graduation my parents’ real estate agent, Russ DesAulnier, asked me to think about what I wanted out of a job. I liked that! It was way more empowering than the usual “What are going to do with an English degree? Teach?” I liked Russ. He was active, likeable and had done a great job for my parents. He had also been a bullfighter in Spain. I had to trust him! I took him up on his challenge and came up with a list:

- I wanted the opportunity to make good money.

- I wanted to be a self-employed professional.

- I wanted to be well-thought of in the community.

- I wanted the opportunity to exercise my creative thinking.

Russ thought about it and suggested that I look at being a real estate agent. He said that the field offered the opportunity to accomplish all the goals I had mentioned.

After I graduated, I couldn’t think of any other viable options, so I began to seriously approach real estate brokerage specializing in investment property as a career. This was after cutting off my three-foot ponytail, a remnant of an earlier era – a sad day!

I lived in a bootleg garage apartment on De La Vina Street in Santa Barbara and bussed tables at the old Miramar Hotel in the beginning. I remember dreading the possibility of a client coming into the restaurant and recognizing me from my real estate efforts. I’d get home around 1:00 AM, sleep a bit and get into the office around 8:00 AM.

I decided early on to have Isla Vista as my farm (geographic area of expertise). No one wanted it! The Bank of America in Isla Vista had been burned in 1970 while I was still attending San Marcos High School. Memories were still fresh. I was advised by fellow brokers that it was a bad idea, that there was no appeal there. That was Ok though; it was the perfect farm for me!

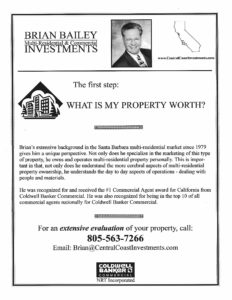

So, 40 years later I have closed 250 transactions just in Isla Vista and often hear the statement that I am the “King of I.V.” My wife and I own some rental properties there. One of these I had brokered three times before wising up and deciding that I was on the wrong end of the game. I was the #1 commercial real estate agent in California in 2000 and in the top 10 in the United States with Coldwell Banker Commercial.

I had asked to speak at the Emeritus ceremony but was told that there were too many agents receiving various types of recognition for anyone to speak. I guess I’ll have to wait until the next 40-year pin! I’ll say here what I had intended on saying if I had been given the chance:

“Brokering properties is a fine career, but it won’t take care of you in your retirement. I have several boxes full of trophies earned over these past four decades. They sit in my garage gathering dust waiting for me to take them out and reminisce over those “glory days”. What has worked out far better is buying rental properties over a long period of time. These will take care of our family in retirement, not those trophies. My father told me this early on and it was good counsel. I’ll pass it on to you all.”

So, lucky you! You get to benefit by my thoughts over a long career. I hope that you use it!

_______________________________________________________________

Brian Bailey is the broker-owner of Central Coast Investments. He is one of the leading multifamily brokers on the Central Coast covering Santa Barbara, Ventura and San Luis Obispo counties. He has had four decades of success and has been a member of the Santa Barbara Rental Property Association since 1983.

Economic Forecast Project UCSB – May 16, 2019

I attended the 2019 South County Economic Summit produced by the UCSB Economic Forecast in May 2019. The first thing I noticed was the group seemed larger than I had expected. Why? Because there were only two speakers plus Peter Rupert as an MC, speaker and panel moderator. I had received an invitation for both the South County and North County events and noticed that there were four speakers plus Mr. Rupert at the North County event and only two speakers plus Mr. Rupert at the South County event.

I decided that I’d attend the South County event as this is the base of most of my business. Note that the UCSB Economic Forecast Project also provided attendees a 138-page study of South Santa Barbara County with lots of helpful material geared towards our local geographic area.

I decided that I’d attend the South County event as this is the base of most of my business. Note that the UCSB Economic Forecast Project also provided attendees a 138-page study of South Santa Barbara County with lots of helpful material geared towards our local geographic area.

The North County event, which cost $50, featured speakers with a strictly regional overview except for perhaps Mr. Rupert. The South County event, which cost $200, featured a national overview with Mr. Rupert reflecting on Santa Barbara South Coast issues.

The South County speakers presented a banking perspective of the national, regional and local economies with Neel Kashkari , President, Federal Reserve Bank of Minneapolis and Kathy Moe, Regional Director, FDIC San Francisco. And of course, there was Peter Rupert, Executive Director UCSB Economic Forecast Project. Kudos to UCSB for producing this event and the sponsors and board. There is an incredible amount of preparation and coordination that goes into this premier annual economic forecast which appears so professional and seamless. I have been blessed with being able to look behind the curtains, so I know!

I’m here writing this synopsis after the event looking at the South and North County invitations and can’t help but compare the two. The South County event usually has more speakers and reflects a national and at sometimes, international overview coupled with Mr. Rupert’s observations on the local arena. Sometimes there have been speakers in more outlier professions like social media and cutting-edge projects like the Allosphere Research Facility at UCSB. I find economics interesting, but I’ve found some of these other speakers truly fascinating! Full disclosure: I was an English Literature major at UCSB so maybe that explains it!

Everyone I mention the event to who did not attend wants a short summary. That is easier this time with the more limited panel. The overriding question at this juncture is “When will the recovery end?”

Mr. Rupert’s is always entertaining as well as informative. His views of the current global economy were “Kinda Sucks” as opposed to the U.S. economy as “Doesn’t Suck” so there’s your short answer! Of course, he did provide lots of material and slides to support those statements.

Both speakers and Mr. Rupert honestly answered that they don’t know when a recession will occur. Kathy Moe gave a very reasoned presentation as to, while the recovery is likely in the latter portion of this economic segment, there are no consistent indicators of an imminent recession. She cautioned that the larger national banks remain at risk in a recession because capital and reserve requirements need to be increased. These banks remain “too big to fail” in a recession like in 2005 and might require taxpayer bailouts if this doesn’t change. However, the current administration is not supportive of increased restrictions.

Neel Kashkari made a personal (non-official) argument that a mistake was made in the string of interest rate increases that occurred in 2018. He argued that the focus on a 2% inflation rate should not be a static target and that many other considerations factor into the equation as to when the economy needs some braking.

Mr. Rupert provided a very convincing set of slides supporting his view that “…when viewed through a historical lens, our economy appears more capable of maintaining long expansions.”[1] This overview was supported by both speakers although all speakers couched their optimism with various qualifications.

So, with that overview and the fact that the rain stopped at the end of the event, I’m very pleased and happy to report a likely positive U.S. economic forecast for the next 12 months!

____________________________________________________________________________________

Brian Bailey is the broker-owner of Central Coast Investments. He is one of the leading multifamily brokers on the Central Coast covering Santa Barbara, Ventura and San Luis Obispo counties. He has had four decades of success and has been a member of the Santa Barbara Rental Property Association since 1983.

____________________________________________________________________________________[1] Economic Summit, South Santa Barbara County, page 2

Apartment Building Income and Expense Statements – Working Magic with Marketing!

Let’s have some fun and talk about apartment building APODs! You know, Annual Property Operating Data statements. I know, you’re wondering how will that be fun? Just wait! You’ll learn how listing agents use these figures all the time to create wonderful-looking GRMS[1] and cap. rates[2]. By magic and slight-of-hand, apartment expenses become 25% of gross operating income! Reserves and management fees disappear. Actual rent is replaced by proforma rent. Is proforma even a real word?

Let’s have some fun and talk about apartment building APODs! You know, Annual Property Operating Data statements. I know, you’re wondering how will that be fun? Just wait! You’ll learn how listing agents use these figures all the time to create wonderful-looking GRMS[1] and cap. rates[2]. By magic and slight-of-hand, apartment expenses become 25% of gross operating income! Reserves and management fees disappear. Actual rent is replaced by proforma rent. Is proforma even a real word?

Now why would someone do this? Do you remember your senior prom? You spent hours picking out what you would wear – yes, men too. If you didn’t own something quite right you’d go out and buy or rent it! A clip-on was OK, or so I was told. You wanted to look your best because this was a special event, right?

A sale is a special event. You only get one chance to make a great first impression. OK, no more banal clichés. So, as the listing agent, you want to have the flyer, video, spreadsheet, background data and demographic overview present the property in the best possible light. On the numbers side you want the GRM as low as possible and the cap. rate as high as possible. And you need to do this without losing all credibility – quite the balancing act! This is where the magic comes in!

To get a true picture of the financial status of the apartment building under consideration, smart buyers and selling agents will look past the listing agent’s glamorous presentation and drill down to the true picture of income and expenses. To do this, you need to have brokered hundreds of sales and reviewed hundreds of these statements like I have or read this handy-dandy cheat sheet!

Working magic with income figures

Now, there aren’t many things you can do with the current rents. They are what they are right? Well, even light waves can bend. I’ve seen the APOD only reflect proforma rents with notations that the units are “currently rented to family members” or “month to month tenancies” or other dismissive language that says, “Don’t look here; move on!” I’ve seen current rents mentioned, but the analysis only comprehends proforma rents. OK; I’ve done this.

What about proforma rents? Has the listing agent included a rent survey? Probably not. Usually, the proforma rents just appear in a column without any backup data. Doing a rent survey is drudge work and, like my fellow brokers, I hate doing it. However, it is the most accurate way to estimate proforma rents if the survey is unbiased. Good luck getting an unbiased rent survey in a listing agent’s package. Do you want a true picture of proforma rents? Just do the drudge work yourself or have your broker do it.

A local alternative would be to use the summary chart for the subject’s sub-area in the Dyer Sheehan Apartment Market Survey[3]. Sometimes I’ll use this but doing an actual rent survey yourself is best.

What about vacancy factor / credit losses? In the real world these always exist. There is always down time between tenancies and collection issues are common. Does this line item reflect the real-world market? Think about it – if your average turnover is say 10 days of turnover work every two years you have an inherent 1.4% vacancy factor even if you rented the apartment on day one. If it took you say seven days to rent the unit on top of the turnover period, you have a 2.3% vacancy factor.

If the GOI[4] in the seller’s books does not reflect the listing agent’s APOD figures, ask why. Is the vacancy factor / collection loss factor higher? Were there some evictions? Is there excessive turnover or downtime? Why?

Working magic with expense figures

Now let’s get to the real problem area in apartment building APODs – expense line items. Here’s where creativity, inexperience, stupidity and little white lies go head to head!

I’ll go in the order of the CCIM APOD[5]. Sorry, another acronym – CCIM – Certified Commercial Investment Member. This is a very prestigious, hard to obtain commercial real estate designation. A CCIM designation involves a serious investment of time and money and, in my opinion, is the highest and most respected professional designation a commercial real estate broker can obtain. If your real estate agent is a CCIM you’re typically in very good hands! My hands are good too though and I have other acronyms after my name and four decades of experience.

Other Income

This would be income from laundry machines, vending machines, parking, etc. Sometimes a broker will “estimate” this as the books may be mysteriously unavailable when the APOD preparation deadline is imminent or the income is “off-books” as in unreported cash income.

Real Estate Taxes

This is another one of my favorites! Listing agents will commonly project 1% of the list price here. That’s it right? Well, look at the current actual tax bill – available online in Santa Barbara county. You’ll find a smorgasbord of additional fees and charges: vector management, flood control, improvement district fees, sewer fees, school bonds, park bonds, library bonds, James Bonds etc. Ever-inventive government loves to tack on additional items to the real estate tax bill to fund an expansive and rather impressive array of dozens of things that never seem to go away. Do you wonder why a sewer charge that is based on water volume is on your tax bill or why there is a new school bond every few years? Sorry; there are no good answers here; just be aware of the additional charges.

I break out the real estate taxes into two lines: the basic 1% charge based on the list price or analysis price and then everything else from the latest tax bill. Now some of these things will change, but I don’t want to research each agency and their formulas. I have a life you know!

Property Insurance

Many people underinsure their properties intentionally or not. Insurance brokers will often quote building and contractor prices from statistical resources that lump Los Angeles and Santa Barbara together. You’ll know from our gas prices and experiences with many local contractors that we are considered a “cornered market”. That means, due to lack of competition, you pay more. Sorry, not sorry. So, an expected bid of $150 PSF for construction costs jumps over the moon here, even for your modest Isla Vista mansion.

The solution: Get a new insurance quote with real Santa Barbara area building costs or that offers guaranteed replacement. As a buyer, this is what you will be paying unless your insurance broker continues to underestimate local construction costs. Do I do this? Not usually. I tend to use whatever the seller provides unless it seems absurdly high or low. What me worry?

Off site and on-site management

If the seller is paying 6% for off-site management, why is the listing broker using 4%? It makes the bottom line look better that’s why! If you own 200 units your fee will be less. If this smaller building is your only managed property you’re gonna pay retail!

My favorite egregious line-item fudge is to have the listing broker not include any off-site management and include payments to an on-site “manager” as a slight rent discount. This is common, but silly since, in most cases, it would be a violation of law. There are specific formulas to recompense a resident manager spelled out in California real estate law including apartment discounts. Learn what they are and use them.

Payroll

What? Yes; in larger complexes you may have several employees involved in site operations and they get paid! I’m talking about people who only work for you regularly. And yes, your resident manager and other employees need workers’ comp. insurance, withholding and all the other items required for any employee. Don’t think any of your worker bees are “independent contractors”. If they only regularly work for the complex they are employees and subject to all the wonderful benefits and red tape of employee management. This would include the next two lines items – Expenses/Benefits and Taxes/Workers’ Compensation. (Yes, the apostrophe is in the right place). Sometimes, these employees and related expenses disappear on an APOD. Maybe they’re on vacation?

Repairs and Maintenance

This is a prime line-item ripe for abuse. The listing agent should just use actual maintenance expenses, right? I do this on occasion, but it can be very misleading. Does the total represent a 12-month extrapolation of the past three months, past 12 months, the past calendar year, an average of the past three to five years or what? Being “selective” in the base period used may produce vastly different figures. Maybe there’s an ongoing slab leak issue that occurred in March. Ouch! Well, if we start the 12-month period in April, problem solved!

I’ve seen this line item expressed as a percentage of GOI. I’ve also seen it as a price per unit allocation. I use the latter method. I don’t want to audit the maintenance expenditures to break out capitalized items. I could get carpel tunnel! I consult with Apartment Building Appraisers & Analysts, Inc. annual workbook for Southern California[6] to get a realistic estimate. This is a wonderful resource for obtaining apartment building expense guidelines.

Utilities

These are “hard costs” and are hard for your listing agent to fudge. See how I did that! However, it can be done! I’ve seen electricity and gas expenses set at zero when I know there are separate house meters for these utilities for outside lights, laundry machines and “clean and show” costs.

Refuse is another shaky one. Is this line item just for refuse only or does it include the often-substantial charges for extra pickups and hauling related to gardening and landscaping? Sometimes the listing agent will drop any charges beyond the basic refuse pickup and forget to put the extras elsewhere even though the books reflect these charges.

A pet peeve of mine (and I have many) is when the listing agent simply lumps all utility expenses into one “utilities” line item. How can you double-check each separate utility expense item? Request separate itemizations. You get extra points for double-checking with each utility provider.

Remember to check for a sewer expense since this may be included on the tax bill rather than as a separate utility billing. When this charge is on the tax bill the listing agent may have “forgotten” to include it and just put 1% as the new tax figure. Voilà; no more sewer charge !

Watch out for a dropped month in a 12-month analysis. The last charge may have been paid late. This becomes even more significant if the charge is paid every other month.

Also, watch out if the overall percentage of total utilities / GOI exceeds around 6%. This may indicate overcrowding, master-metering or a water leak.

Accounting and Legal

This line item is often omitted and I see why. The owners total accounting bill includes work for the subject property, but the bill is not separated out for the property. I usually assign some nominal number to this work as an estimate. Look for legal expenses in the books as lots of entries may indicate systemic, negative tenancy issues like sloppy tenant screening.

Licenses / Permits

The City of Santa Barbara has an annual business license requirement for every apartment building based on income and yet this charge is seldom reflected in the listing agent’s expense statement. It could be a nefarious omission or just ignorance. Frankly, I vote for the latter. It will usually be reflected on the owner’s books as their interests are in maximizing expenses whereas the listing agent’s interests are in minimizing expenses. View the application that includes how to calculate the amount in the city of Santa Barbara here – https://goo.gl/dpKjex

Advertising

The management company may bill this out separately or it may be buried in singage installation, promotion or somewhere else. If I don’t see it, I put in a nominal expense.

Supplies

Most management companies will break out this separate line item from maintenance. I drop it and incorporate it into the price-per-unit maintenance estimate that I use.

Contract Services

This would be for say landscaping, gardening, cable TV, Dish TV, internet, pest control, fire extinguisher maintenance, furnishings in furnished units and anything that is an ongoing, contracted expense.

I usually see gardening grouped with landscaping. Some landscaping should be reflected in reserves because it may be a capital expense. Be sure that these line items reflect any extra hauling expenses or that these additional costs are reflected in the refuse line item or elsewhere.

Reserves

This would be reserves for capital expense items, i.e. roofing, asphalt replacement, appliance replacement and basically any item that your accountant would tell you needs to be capitalized rather than expensed.

Now for some esoterica! Where should the reserves line item go? Sometimes it appears in expenses. Sometimes it appears below the expense total as a separate itemization. Rather often it is entirely missing! The CCIM form places it below expenses and NOI. Appraisers have waffled back and forth on where to place this line item with the current norm appearing to be to include it in expenses.

To obtain an accurate cost estimate for reserves, an appraiser must itemize each possible capital item, estimate the lifespan of each item, estimate the remaining useful life of each item and then provide for an annual sum that should be set aside for its eventual replacement. Of course, this will vary property to property. There are tables and guidelines for this, but wow that is a lot of work! Some appraisers will do this. I’ve never seen an agent do this though. I don’t do it. Sometimes it’s estimated as a price per unit (my choice).

Why is the placement of the reserves line-item important? It is usually a large number, often near to or exceeding the maintenance figure. So, if it is not included in expenses, the cap. rate estimation (NOI/Price or Value) will be higher. Learn what the norm is in your area so that you are comparing apples to apples. Remember, an apple a day…oh! I said I wouldn’t do that cliché thing again. If the norm is for reserves to be included in expenses and the listing agent has put it below the NOI line, the cap. rate looks better, but it is misleading when trying to determine if the deal is good compared to other opportunities or past sales.

Wrap-up

The real-world overall expense ratio on a typical, separately-metered local apartment building is going to be around a third to 40% of GOI. Sorry, but that’s reality. If you see any substantial variation from this general rule look out! Something is askew or entirely unique.

Master-metered and high-abuse properties feature higher expense percentages. A brand-new or entirely remodeled building will feature lower expenses.

So, there you have it! I hope that you are now more aware of how these line items can be, shall we say, “nudged”. Remember, the APOD in the marketing flyer represents the property in its best possible light. What you want are just the true facts.

____________________________________________________________________________________

[1] GRM (Gross Rent Multiplier) – Sales price or value / annual scheduled GOI (Gross Operating Income) – The lower the better

[2] Cap. rate (capitalization rate) – NOI (Net Operating Income) / sales price or value – the yield of the property without respect to debt – The higher the better

[3] Santa Barbara County – South Coast Apartment Market Survey, Dyer Sheehan Group, Inc. (805) 653-8100, www.dyersheehan.com

[4] GOI Gross Operating Income – Gross income after vacancy and credit losses plus other income

[5] CCIM APOD forms https://goo.gl/n5xcW8

[6] Apartment Building Appraisers & Analysts, Inc. Joseph G. Queen 562-434-0571 jgqueen@aol.com

____________________________________________________________________________________

Brian Bailey is the broker-owner of Central Coast Investments. He is one of the leading multifamily brokers on the Central Coast covering Santa Barbara, Ventura and San Luis Obispo counties. He has a four-decade history of success and has been a member of the SBRPA since 1983.

When Real Estate and Destiny Intersect

My wife, Terri is going through boxes of pictures and came across this one from around 1983. This was a dinner celebration at the Harbor Restaurant on the Santa Barbara wharf. I had taken Terri to lunch several times, but this was our first “real” date.

My wife, Terri is going through boxes of pictures and came across this one from around 1983. This was a dinner celebration at the Harbor Restaurant on the Santa Barbara wharf. I had taken Terri to lunch several times, but this was our first “real” date.

I had promised Dinh Truong, a client of mine, that I would take his family out to a lobster dinner once we closed what would become the International Market building at 6551 Trigo Rd. in Isla Vista. His wife Nhan Vu is in the front of the pic. on the left and Dinh is on the right. On the left, beginning from the front are his children Nhan, Dinh (Jr.) and Hua. I am sitting behind Dinh on the right and Terri is behind me. Yes, I had brown hair at one time!

Dinh was a pilot in the South Vietnamese Air Force when the war was lost. He remembers being in the air and hearing the announcement. He couldn’t believe it. Once he landed, the family had about 30 minutes to leave the country. The family immigrated to the U.S. and opened a market in the 400 block of Anapamu St. at the dead end at 101 next to a pedestrian overpass to the Westside. The market was in the front of the property and the family lived in an apartment in the back.

I was referred to him by a fellow agent in 1982. The market had been robbed twice and his son had been shot in the leg. It was time for a move. We began to scout out alternative investment properties. Dinh and the family ended up being great clients and good friends over decades. They purchased four commercial and multifamily properties in Isla Vista over the next 10 years.

Meanwhile, back to the dinner. Nhan Vu ended up sitting next to Terri after dinner. Terri had a bit of trouble with the accent, but she did hear Nhan telling her that she would marry me! At this point, Terri wasn’t sure she even liked me, so this was a pretty shocking conversation to her. I did know that Nhan was what the family referred to as a “seer” or “truthteller”. She was clairvoyant. How’s that for a first date? We married in 1985 so we’ve been together for 33 years!

Dinh was able to put daughter Nhan through medical school and Hua through dental school. His son, Dinh, helped operate the business and inherited the business and property when his father died about a decade ago. The other family members moved to Orange County.

I visit with Dinh Jr. and his wife and two sons occasionally and I’ve talked with the daughters and Nhan once in a while. I miss Dinh immensely. We had a great friendship and he was always very grateful for my help. Tears come to my eyes when I write this.

I feel blessed that Nhan’s prediction was right about Terri and I. I also feel blessed to have known this great family!

Will Apartment Buildings be Worth More in 2018?

Here is a good, succinct article by Les Shaver from the National Apartment Association (NAA) series discussing value trends of apartment buildings in the U.S. in 2018: Link

Here is a good, succinct article by Les Shaver from the National Apartment Association (NAA) series discussing value trends of apartment buildings in the U.S. in 2018: Link

Santa Barbara Executive Roundtable – Anticipating and Bracing for the Next Recession – Expert Panel – Nov. 9, 2017

Santa Barbara Executive Roundtable (SABER) hosted their annual economic forecast meeting today, Nov. 9, 2017. The talk was titled “Anticipating and Bracing for the Next Recession – Expert Panel”. That sounds ominous, doesn’t it?

Panel members were:

Brian Johnson, Manager of Radius Commercial Group. Brian is also an active real estate agent in the multifamily sector locally.

Brian Johnson, Manager of Radius Commercial Group. Brian is also an active real estate agent in the multifamily sector locally.

Justin Anderson, President of AmeriFlex Financial Services. AmeriFlex provides financial planning services locally.

Justin Anderson, President of AmeriFlex Financial Services. AmeriFlex provides financial planning services locally.

Keith Berry of Coldwell Banker under the moniker of Keith Berry Real Estate. Keith has had a very long career in local real estate office management and sales. He specializes in high-end residential properties.

Keith Berry of Coldwell Banker under the moniker of Keith Berry Real Estate. Keith has had a very long career in local real estate office management and sales. He specializes in high-end residential properties.

Mark Schneipp, Ph.D. of California Economic Forecast. Dr. Schneipp has been providing economic data and forecasts locally for several decades.

Mark Schneipp, Ph.D. of California Economic Forecast. Dr. Schneipp has been providing economic data and forecasts locally for several decades.

_____________________________________________________

None of the speakers spoke on any assessments or forecasts on their various segments of the local economy much past 2018 although Mr. Anderson did say that a recession of some sort was to be expected “sometime this decade”.

Mr. Johnson spoke on the entire commercial sector on all asset classes (and in about 10 minutes!). The overall assessment was that the market was not poised to experience any vast correction in 2018. Multifamily rent growth is not expected to feature the torrid increases seen over the past few years of 3% to 5%. He stated that it may be as little as 1% in 2018. Commercial and industrial vacancies will remain less than 5% in the overall market.

The sector most in the news is retail with numerous State Street vacancies coupled with the closing of Macys in the Paseo Nuevo center and the upcoming closing of Saks in the 1000 block of State St. Brokers and retailers complain of city neglect, the homeless, etc., but the more obvious culprit is the huge success of online shopping.

He talked about the current rounds of “re-imagining” downtown retail that is occurring in the community involving governmental and businesses interests. Having office uses of first floor retail space like financial institutions is an ideal solution as these uses are shuttered at night and don’t promote an active, people-oriented draw. Utilization of the upper stories in State Street buildings as residential is high on the radar. This is not a new concept. In my experience, a trip to Buenos Aires would provide an example of proper urban planning with multi-story downtown buildings featuring first floor retail, office uses on the next couple of floors and the balance being apartments and condos. Parks at least a block in size are present about every 11 blocks for use by the people living downtown. A very efficient, inexpensive rail system transports around 2,000,000 commuters from suburbs to downtown and back every work day.

Mr. Anderson spoke of the current economic environment as being “around the seventh inning.” He advised that retirees begin to pull back from riskier investments and to avoid irrational optimism concerning stock valuations. “It’s no time to be on autopilot!” he advised. Better choices may be found in European and some other international emerging markets. These markets are not as far along in their recoveries as the U.S. and therefore farther away from a peak.

He was the most circumspect of the group of speakers concerning an upcoming recessionary environment. However, he did expect the U.S. markets to have another great year in 2018.

Keith Berry read his assessment of 2017 from this economic roundtable meeting last year. Every one of his forecasts proved to be accurate. He said that this market will be a repeat of last year. All residential sectors are well within expected norms for volume and activity.

Mark Schneipp was the featured speaker and had a lot to say. The net of it was that he forecasts that there will be no recession in 2018 for the following reasons:

- The U.S. is at “full employment”.

- Inflation remains low at around 2.2%.

- Interest rates remain low.

- Lots of infrastructure packages are in play.

- The likelihood of an unexpected negative international event is low.

Dr. Schneipp’ s assessment of anything like Kim Jong Un launching nuclear missiles at the U.S. is “entertaining”, but so unlikely as to be dismissed in a forecast for 2018.

He flatly stated that elements of the current proposed Trump tax plan revision will have a negative effect on real estate values in areas in the U.S. featuring high real estate values / taxes and high state tax rates. That, of course, would include California.

Overall, he stated that “2018 will be stronger than ever!” So, why the ominous headline for the meeting? Negative news is what sells and what fills meetings. We all felt greatly relieved at the promising news.

Isla Vista Duplex – 13.3 GRM / 5.17% Cap. Rate

It’s a wonder what a $300,000 price reduction will do for the numbers! Here’s what we have now:

- Location: 6670 Sueno Rd., Isla Vista, CA – 3 blocks to UCSB

- Price: $2,095,00-0 – 13.3 GRM / 5.17% Cap. Rate

- Income: Leased from July 2017 to July 2018

- Flyer: Click here

So, how good is this? These are the best numbers for any multifamily property on the market on the Santa Barbara South Coast. Don’t wait!