South Santa Barbara County Economic Summit

Economic Forecast Project, UCSB – April 2015

I attended this program on April 30, 2015. Note that they called it an “economic summit” and not the more typical “economic forecast”. There was not a lot of forecasting done. But that’s OK; predicting future macro-economic events is a bit like predicting the weather a year from now.

I enjoyed this program as usual. It is a nice break from similar local events more geared towards marketing and provided a more neutral viewpoint of macro and micro trends for the Santa Barbara area with bits of wider information on California, the U.S. and the world. UCSB is a world-class university and this event measured up to its high standards.

On the local real estate front – now here’s a surprise: high demand, low supply, rising prices, problematic affordability both on the purchase and rental fronts. Of course, we’ve been hearing this in an endless loop forever, so it’s not likely to change.

Mark Flannery, Chief Economist and Director, Division of Economic and Risk Analysis at the U.S. Securities and Exchange Commission gave a talk about the different levels of risk allowed between “registered” investors and everyone else. This was interesting as I had not realized the entirely different level of risk that is OK with those that oversee these things for people of high net worth and income. It is very expensive to comply with all of the auditing and disclosure requirements in the sale of securities to your man on the street, but your 1% investors get to fly by the seat of their pants. I don’t know if this is a good thing.

By far the most interesting segment of the program was the segment on “Business in The Social Media Age” with Matt Kautz, Director of Social Media and Analytics, Walt Disney Studios and Lisa Jenkins, VP of Marketing & Client Services, The Marketing Distillery. This segment was moderated by Megan McArdle, Columnist, Bloomberg View. Megan did a great job of moderating this cutting edge segment and injecting great humor into the discussion.

If you are not involved in social media in your business you should be. The different social media agents were broken down as to how they might assist the entrepreneur in targeting core groups. Facebook remains the most important and versatile form of social media. Google analytics provides some very interesting data engines to comb all social media for mention of your company, name or interests and email you when a hit is found. Social media is essential in creating brand identity. Expect to spend two to three hours a week on posting and blogging in order to be effective. Define what you want to accomplish and who you are targeting. I guess that this is my weekly contribution right now!

Another extremely interesting segment was a presentation on the AlloSphere Research Facility at the NanoSystems Institute at UCSB. This endeavor is an effort to present visual data analysis in a three and four dimensional venue. Is your head hurting yet? Mine was.

This facility is a sphere located in the California NanoSystems Institute building (Elings Hall) at UCSB. The presentation example involved an examination of the decoupling of the Swiss Franc from the Euro that occurred on January 15, 2015. This move caused a 23% rally in the Swiss Franc almost overnight. The AlloSphere example was a minute by minute examination of this event from several axes. If your head isn’t hurting by now, check your pulse!

Wow! I actually can imagine some applications in engineering and physics, but I am having a bit of trouble understanding how this would be an improvement in economic analysis which would typically be various charts and spreadsheets. As an English literature major maybe I’m not supposed to. But I don’t care. This was a truly amazing presentation. I had no idea of the existence of this facility 10 minutes from my home. I wonder what other wonders lurk on campus?

So, how are we locally and in California? We are doing quite well locally except for the ever-present bugaboos of affordability and the ever-decreasing middle class. Employment has continued to click up quite nicely in comparison, but most job creation is for low-paying positions. Something that will warm some local hearts is that local government employment, the not-surprising largest local employer, actually decreased a few percent from the prior year.

We are doing far better than much of the world though. With Europe, Russia, China and Japan in the economic doldrums our historically modest economic accomplishments look quite good. Look forward to more disturbing news about the economies of Greece, Italy and Portugal.

So, guess what? We are in one of the most sought-after parts of the United States which is doing quite well thank you in relation to most of the world! That’s got to be good news. And no one else has an AlloSphere to boot! I went away quite happy! Now to work on my blogs…

The Mark, Tempe, AZ – 228 beds

The Mark, Tempe, AZ – 228 beds

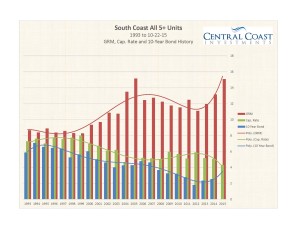

Click chart to enlarge.

Click chart to enlarge.