Review: SABER Meeting, Nov. 10, 2016

Changes Ahead in 2017: “Renewed Economic Vigor or Collapsing Into Recession…?”

__________________________________

I attended the Santa Barbara Executive Roundtable (SABER) on Nov. 10, 2016. This group generally holds monthly meetings at the University Club in Santa Barbara. Topics are timely and feature great speakers. The meetings are open to members and the public. The public cost is $35 per meeting if paid in advance.

I don’t attend every meeting as some of the topics are not of interest. I was excited about this meeting as it was just post-election and featured a great speaker lineup:

- Mark Schneipp, PhD – California Economic Forecast

- Brian Johnson, General Manager – Radius Group

- Keith Berry – Keith Berry Real Estate (Coldwell Banker)

- Justin Anderson, President – AmeriFlex Financial Services

Locals will recognize these men. Mark Schneipp was the go-to economist for the Statistical Review Committee for the Santa Barbara Board of Realtors for years and was on staff at UCSB and featured at their economic forecast events. He is independent now and always insightful.

Mark Schneipp was featured last as he was the lead speaker. His take on the election reminded me of Alfred E. Neuman of Mad Magazine – What me worry? We basically have full employment, less debt and higher wages. What’s not to like? The stock markets had recovered and then some by this date and are expected to remain stable at least in the near term. Interest rates will rise in a long-predicted, stable manner. Real estate markets will continue in the same trajectory. Millennials will postpone buying a home or can’t afford one. Unemployment in this segment is much higher than with the 35+ year old segment. Buying a home is just not as popular an option for this group as in prior generations and they’re OK with that. Coastal markets will remain unaffordable with a dwindling middle class and the social dislocation that comes with that.

However, the one thing we can count on over long periods of time is that markets fluctuate. They do not ascend in an upwards pattern forever. This is one of the longest expansions we have had. We are due or perhaps overdue for a change, so don’t be surprised when it comes. Be prepared.

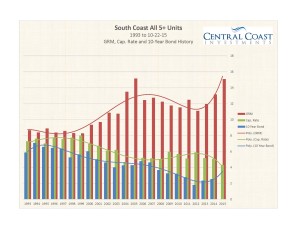

Brian Johnson is a bright, young man who has some impressive brokerage production under his belt. He is now the general manager of Radius Group, one of the larger commercial real estate companies locally. Brian gave a snapshot of all local commercial markets. The local commercial and industrial markets have exhibited stable to shrinking vacancy rates and surprise! The Funk Zone is the hot retail market. There is lots of activity in the multifamily market with the number of sales volume set to surpass the 1999-2000 mark. I track this market niche and can tell you that the cap. rates are at the lowest point since 1993. That doesn’t seem to affect volume though. Almost 1/3 of these sales have been off-market. There is substantial demand.

Keith Berry – What can I say? I’ve known Keith from the beginning of my career in 1979. He was one of my mangers. I have a great deal of respect for Keith. He is a gentleman and thoroughly knowledgeable in the local residential market, especially the upper-end. Segments of this market have shown fewer sales than in 2015. Escalating prices and fewer sales make for a few very shallow market segments. Most of the lower-end and mid-range market is not much changed in volume.

Justin Anderson – I don’t personally know Justin Anderson very well although I have met with members of his firm several times in various real estate related financial planning meetings. Justin was cautious which I thought was good advice. He felt that certain sectors of the market have some opportunities for safety and perhaps some growth. He named dividend producing stocks and seemed excited about some plays in the health-care market that has been particularly hit hard of late. He advised defensive plays in today’s market. In his opinion, the market has just been good for far too long.

__________________________________

Brian Bailey is the broker-owner of Central Coast Investments. He is one of the leading multifamily brokers on the Central Coast covering Santa Barbara, Ventura and San Luis Obispo counties. He has a four decade history of success.

Save

Save

The Mark, Tempe, AZ – 228 beds

The Mark, Tempe, AZ – 228 beds

Click chart to enlarge.

Click chart to enlarge.